A large part of our weekly tips involves keeping money in your pocket. So, today, here are four ways to do just that:

Are you interested in getting something done for cheap? These days, what do you actually get for five bucks? Well, there is a very cool new website called fiverr.com. For five dollars, there are a huge number of people who will do anything from critique your resume, to setting up and posting a You Tube video for someone’s birthday, or will build a one-page web site for you. The list of what’s available is endless, and there is also a section for you to post what you want done for five dollars, that someone can choose to take on. Check it out.

Cell phone two or three-year contracts are a really bad financial trap, that’s something we’ve talked about before. In the last quarter, 75% of Americans who got a new cell, or had their contract come up, did NOT sign for another contract, but went to a monthly plan. THAT is exciting, and a wave that will come to Canada with the new players now in the market. With no contract, you are not stuck for three years.

That is exactly why the I-phone is not the biggest seller, not even the 2nd biggest seller, because the only way to get one is to be locked into a contract! Many Blackberry and Google phones don’t handcuff you. Bet Apple isn’t that happy, either.

The reason the big companies want to hook you into a three year contract is that they are afraid. They are afraid that you’ll find a better deal, better service, or just afraid to compete in the marketplace. When the carriers have you hooked, it no longer matters that they’re not the best, cheapest, or whatever the issue, because you’re not going anywhere! I don’t use a cell much and loaded $100 on my pre-paid cell. It lasts me a year – that’s $8 a month!

Wireless cards for laptops are a great convenience. It means you can literally get on the internet anywhere, anytime. They’re reasonably inexpensive – on the surface. But be careful and watch the traps: A caller on the Clark Howard show had a $62,000 data bill. What did he do? He downloaded the movie Wally, for 35 minutes while vacationing with his kids in Mexico. The cell phone company who sold him the plan reduced it to $17,000. Isn’t that a deal? A $17,000 bill so his kids could watch a movie download.

The internet access is charged by megabyte, not by minute, if you do not have an unlimited use plan. Even then, check that you are not paying roaming charges when you are out of your home area. You’ll have to ask, because it’s not something they’ll volunteer to tell you when purchasing the plan.

An equally expensive story was that of a U.S. visitor using his Blackberry internet for 16 minutes at the Toronto airport and getting a $5,000 bill! Be careful and ask first!

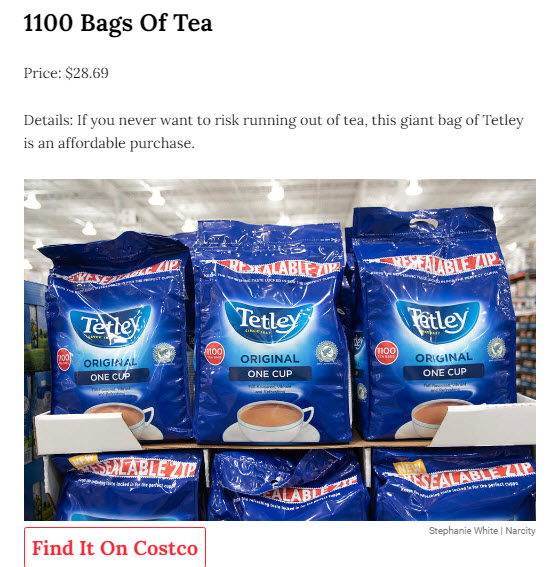

Two University professors recently did a study that showed we spend more at Costco than we intended. Gee, we needed a study for that? Yes, it’s hard to get out of Costco for under $100. The way I do it, is to NEVER take a cart. When my arms get full, I stop buying more stuff, or change my priorities. No wonder that the average Costco store does $134 million in volume a year! But the good news is that their mark-up is always 14%, and Costco, on things like televisions, doubles the warranty period from one to two years. I recently bought my LCD using my Amex card, which also doubles the warranty. So I may have just turned a one-year warranty into four years. I’m not sure if the double Costco warranty doubles again with my Amex – and I hope I don’t have to find out.