The first week in March, the markets plummeted. When we talked on March 6th I indicated not to worry, they’d be up 15% again within six months.

In fact, the week after that brought Black Monday, as traders have termed it. The markets tanked again – and a lot worse – with the Dow having its largest one-day drop in history (1,800 points).

Fast forward to yesterday (September 1st) since the over-reaction is behind us and last week all markets have recovered their losses for the year, and have all set new all-time highs. I only talk about investing twice a year and in broad terms. That’s not my degree. But I am an interested spectator because I manage a seven-figure investment for a relative. It’s up 15% for the year so far, because 70% is invested in tech related mutual funds. One thing I can’t tell you about is the Canadian market. The investment firm handling the account has not invested in commodity heavy Canada for over six years.

March 3rd: Dow 25917 S&P500 3023 NASDAQ 8738

March 9th: Dow 18200 S&P500 2191 NASDAQ 6631

Sept. 1st: Dow 28645 (up 57%) S&P 500 3526 (up 61%) and the tech-heavy NASDAQ 11939 (up 80%)

Yes, the 75% NASDAQ rally in August was Apple, Facebook and Amazon while other companies were getting wiped out…but that’s the reason I would never manage my own investments and you always need to have a diversified portfolio. The flavour of the month might not be the same one as next month or next year!

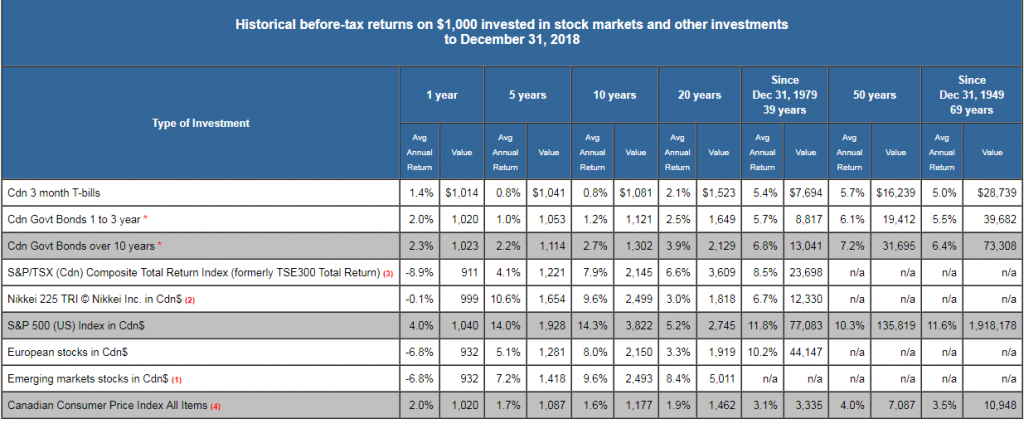

History will always repeat itself. When we see such massive drops in our investments, our mind tends to think it’ll go on forever. Now, with 20-20 hindsight, just as every market correction ever, we can look back at our March investments with a different mindset: The market always bounces back – especially when it overreacts.

The people who have not recovered – and may never recover are those who gave up and cashed out. It guaranteed that they locked in their losses. It’s done by millions of small investors in every major meltdown. They were there for the down rollercoaster and got off at the bottom, forgetting that the investment roller coaster always goes up – way higher than the bottom at which they cashed out.

Do remember that investing is a time horizon of five years or more. If you need the money in less time, you need to save and not invest – that’s a basic savings account or GIC and not the market.

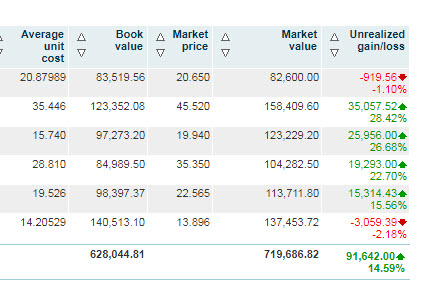

The investments I oversee are in a managed portfolio with a national firm. There have been some hits and certainly some misses:

Pimco monthly income fund has been a horrific underperformer for years. Yet, the firm is adding more of it. Conservative portfolios need a fixed income percentage – I’m guessing Pimco is the best of the worst at these historically low rates.

The firm purchased a gold ETF on May 1st (Ishare SP/TSX GL GLD ETF) but sold it a month later at a $16,000 loss! Six weeks later, with Gold setting new highs week after week it would have been a $26,000 gain! That’s a difference of $42,000. The firm didn’t respond to questions from me. NOT happy at all!

In 2019 the market went nuts in the first quarter of the year. Yet the investment firm sat on the sidelines and did nothing. They’ve since admitted that they “missed” that huge wave…not good, but at least they owned up to it…

On the “win” side, Dynamic ACTV GLB DIV ETF is up over 28% for the year and it’s been a holding for some time, along with a NASDAQ index fund (there are many of them in either Canadian or US dollars)

Those examples show, once again, that even the professionals don’t have all the answers and don’t always get it right.

Next week we’ll wrap it up with some basic ideas on what’s next for the markets and if you should get out…(you shouldn’t…)