Category Archives: Uncategorized

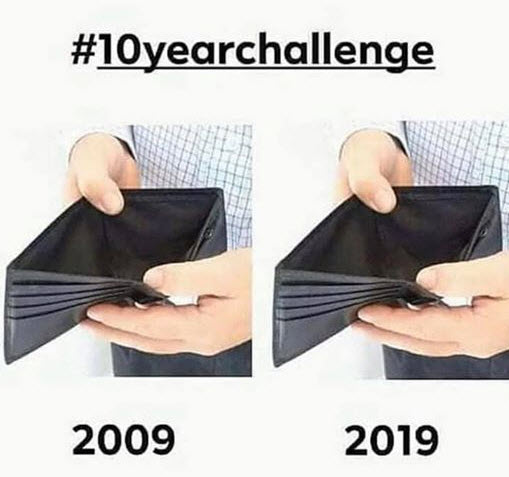

Facebook 10-Year Challenge

Facebook people have a new (to me stupid) “challenge.” Post a picture of you 10-years ago and now. No thanks…but here’s one that should apply to a lot of people:

THE Best Place To Shop & Save

As discussed this week from Phoenix, Dillard’s Clearance Center is one of my go-to places for shopping in the U.S. Just google them and you’ll find their clearance centers in California, Ohio, Arizona, and other states.

These aren’t fancy stores, just racks and racks of last years’ merchandise – unloved and unsold. Everything in the store is 60% off – period. That may get you a good deal on some things, but I look for the weekly additional discounts. They rotate them every Tuesday. This past week (hurray for me) it was an additional 65% off on mens shorts, dress shirts, and casual pants.

So on a $50 sticker price (careful as sticker price is as made-up as it is at Winners, vehicle MSRPs, the jewelry business and for a mattress) you would pay $17.50 with the permanent 65% off. The additional 60% off is from that “new” $17.50 and then makes it $7. Casual pants for US$7, 100% cotton dress shirts for under $10, and thousands of shorts to choose from under $5. LOVE that. Sorry, ladies, I know three quarters of the stores are for you – but you’ll have to do your own discoveries.

If you can find a better prices elsewhere – let me know…

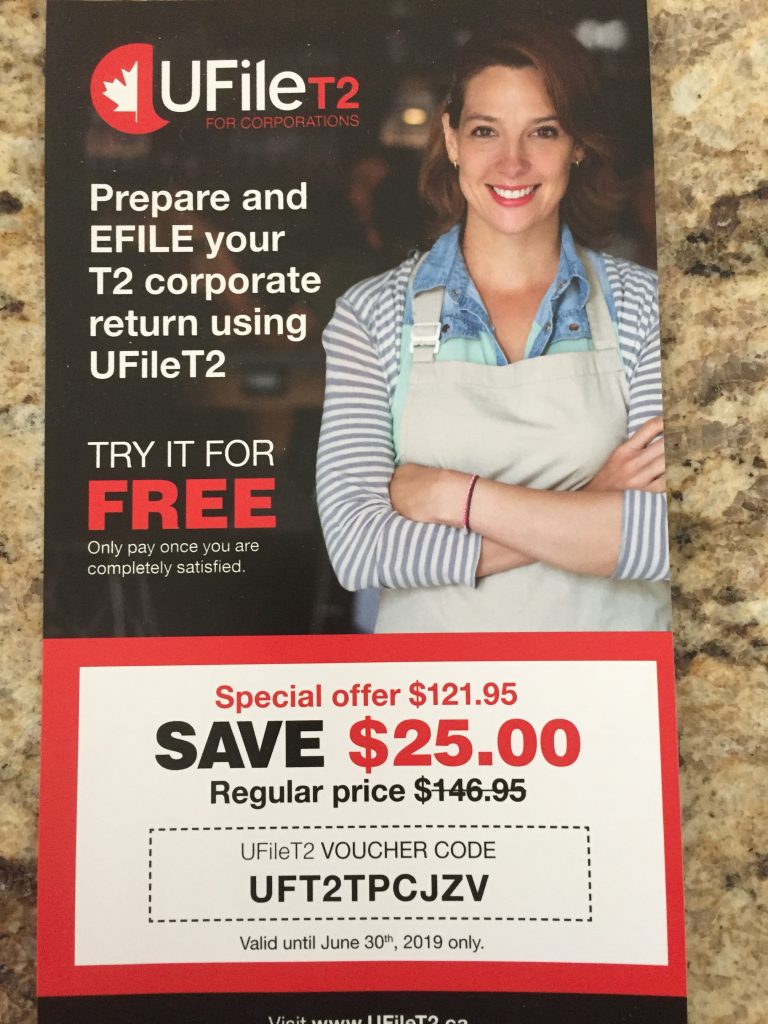

Buying Corporate Return Tax Software?

If you have a reasonably simple company return to do, you’ll need to file a T2 return. If you have a reasonable understanding of assets, liabilities, and your income statement, there isn’t a reason you can’t do it yourself in about an hour or two. If so, it’ll save you around $500 over an accountant doing your return – but only if you’re comfortable with it.

Two companies sell T2 tax software. You’ll need to buy the “business incorporated” program. The two are from UFile or Intuit (Quicken). They both do the same thing – obviously – but are VERY different prices.

UFileT2 is $147 with a $25 coupon (below). Intuit Turbotax Business is $250. I have no idea why it’s double the price for something that does the same thing. Their media relations spokesperson Bryan Tritt promises to get back to me with an answer to that question. I’ve been waiting over 90 days to hear back as of today…Guess no answer is still an answer…

If you’re not sure you have the basic knowledge to do it, the UFile program is on-line for free. You only pay once you’re ready to press the “submit to CRA” button. So give it a go…and both programs have warnings if something is missing or incorrect in your numbers…

George Boelcke – Money Tools & Rules book – yourmoneybook.com

Adult Graduation to Financial Reality

One More Very Personal Cruise Story & A Challenge For You

Greetings from Los Angeles!

Yes, I’m still in LA, having just finished my Mexican Riviera cruise on the Norwegian Epic that we talked about last week. If you missed it, the texts of the programs are always posted on yourmoneybook.com. Just click on the radio stories button and you’ll find last week’s story, and the most recent on the Norwegian Epic from November, as well as the other 300 or so programs.

As some of you may know, in addition to my books and radio program, the largest part of my life is my purpose and passion in teaching team building and leadership seminars all over the world. What always drives me crazy is companies who promote “our people make a difference” on their web site – and only their web site – because they don’t actually mean it in real life.

Yet, the cruise industry, and (from what I’ve observed) Norwegian in particular, has created a culture where their people do make a difference – in actions and not just slogans. You’ll find the staff to be totally attentive to you, incredibly professional, and more than patient; sometimes with passengers who wouldn’t treat their dog the way they treat some of the 1,100 staff.

Christopher is from a small town in Indonesia and only six months into his first ten-month contract on the ship. He actually starts work at 1 AM doing clean up and prep work, so he’s not exactly on a shift where most passengers would ever see him or meet him. Kerthney is from St. Lucia in the Caribbean. She is the keeper of the soft ice cream machine. While that might not mean much to you listening to me – it means a lot to not only the kids, but the adults on any Norwegian ship…you’ll see… This week, Kerthney is celebrating her third month on the ship.

Those are just two of almost 1,100 staff from dozens of countries. Most of them don’t have fancy titles, and their cabins are below the water line, shared with three other crew members. They work for very little money when compared to North American wages. Sure, it’s often a lot compared to the average wages of their home country, but it’s also very lonely and incredibly far from home. Their shifts can be more than half the day, and there’s no guarantee that they’ll be offered another return contract at the end of each 10 month period.

On a cruise ship, most people will meet the omelette chef at the custom-order station, one or two of the hosts in their favourite restaurants, a couple of the bartenders, and their room stewart – but that may be it. However, it’s the other one thousand plus staff who are just as invaluable to making your cruise a memorable experience. So the next time you go on a cruise – any cruise – make it a point to make eye contact and say a quick hello and a thank you…to the ‘non-obvious’ people. If every passenger on the average sized ship did that just five times a day, those 85,000 plus hello’s and thank-you’s for the week make up for a lot of loneliness, hard work, and long hours.

You know this in your own life at work: Being appreciated doesn’t replace your income, but sometimes it’s just as important. In fact, until you book a cruise – and you should – start practicing closer to home: In the restaurant, while you’re shopping, or anywhere else. It matters a lot – to a lot of people. If you want to understand more about the people part of your life at home or at work, cruise through my web site at: vantageseminars.com

Next week, we’ll get back on the financial track and talk about the dangers and downside of debt consolidations. But I’ll give you a hint: What word do the first three letters of consolidation spell?

Three Financial Tips If You’re Traveling

A long weekend in Venice, Italy was a good reminder for me to share a few heads-up when you’re traveling out of the country.

-Make sure you pack at least two different credit cards, or a credit card and debit card. If one doesn’t work, you need a plan B. It happened to me when my MasterCard came up with the error message that some international connection couldn’t be made. In other words – the computers couldn’t talk to each other. If you’re traveling with your partner, a joint card isn’t the answer. If one of the cards is lost or stolen, it’ll cut the other one off, too. Better safe than sorry or your holiday won’t be very relaxing.

-If you’re traveling anywhere but the U.S. your credit card has to have the new chip technology. By now, probably every Canadian card has been replaced, but make sure. I needed to help three times in Venice when Americans couldn’t use their credit cards. It’s strange that the country who invented the credit card (and millions of people really wish it hadn’t been invented) still doesn’t have this chip technology. Without it – your card can’t be used in Europe and many other places.

-Get your money when you arrive. I watched someone at one of the big banks obtain $1,000 Euros. If he had done it in Europe, he’d have saved around $50. I walked up to the first ATM at the airport and got some money fee-free and at a much better exchange rate.

On a personal note, if you’re ever heading to Venice, my suggestion would be to get a hotel outside the city. I stayed at the Best Western Airvenice for $51 a night (www.hotelairportvenice.com). It’s a 4-star, but the ratings in Europe aren’t the same as North America.

The hotel was immaculate and looked like new. There wasn’t a single thing out of place or worn down. Staying in 50 or so hotels a year, it was the nicest one I’ve stayed at in years. The hotel staff all speaks English, and at this hotel, or many others in the area, you’re a 20-minute train ride from Venice. If you want to be five minutes away, there’s another Best Western in Mestre. I’m glad I did stay in the suburbs after watching tons of people arrive in Venice itself and hauling around a ton of luggage through cobble stone streets. Then hauling everything up and down stairs over a ton of bridges with maps that are semi-useless in how the city is laid out. Trust me on this one…

By the way, if five days in Italy sounds exotic or expensive, it was a Lufthansa $700 all included seat-sale in February. When great seat sales come along, get the ticket to…wherever… and then figure out what you’re going to do there and why you’re going! With flight, hotel, and meals, I got there and back for under $1,000!

Another Week – Another Scam

You are not exempt from the law of gravity. You and I also aren’t exempt from that little part of our brain that gets greedy and wants it all today. That comes to spending as much as investment returns.

On the spending part, we think that it’s not really that much per month or in total, and we get wildly and wrongly optimistic that we’ll pay it off sooner than reality or our income will ever allow. Besides, we think we make maybe $50,000 and we deserve it. Well, we don’t make $50,000 by the time taxes come off and all the bills we already have. But that little part of our brain conveniently forgets about that.

We can get just as stupid about investment returns when that part of our brain forgets about common sense. Savings accounts are around 1% right now, and the stock market has a historical return of 8% to 10%. So when someone tells us we can get a risk-free 18% to 22% return we have two choices: We can laugh and tell the guy to get lost because it’s always a scam, or has a big catch. But often we don’t. That little greedy part of our brain says: Well, that’s a great idea – and never mind the fine print, that we’ve never heard of the firm, and that it’s way too good to be true.

And thus, another scam or Ponzi scheme succeeds. The latest one unraveled in Alberta for over $52 million. Surprise! The police can’t find the people involved and the accounting firm can’t find any of the money. This one even conned a really successful Western Canadian businessman for $6 million.

If it’s 20 times what the bank pays, and double or triple the best market returns, it’s a scam. Stop and listen to the part of your brain that has the common sense gene and know only slow and steady wins the investment race.

All that glitters is not gold anymore. The hype of gold seems to be cooled off – or turned cold. That can’t miss investment and the only safe place from inflation was another fad like so many others. Sure, those still invested and everyone who has a stake in selling you gold tells you it’s just temporary. If you look through our stories, I’ve warned you away from golf three or four times. Now it’s down to the $1,300 area code from a high of $1,900 or so.

That wasn’t much of a hard prediction. Gold is massively volatile and subject to extreme downturns. A 30-second internet search past all the hype would have told anyone that. Tons of people have lost a fortune. That’s sad, but totally unnecessary. Slow and steady investing always wins the investment race. Those people got greedy and I guarantee they’ll get greedy again on the next sure thing in the hope of making it all back in one shot. They should have gone to Vegas, instead.

Can You Do One Cash-Flow Statement?

Last week we briefly touched on the fact that gas and groceries keep going up. That makes your expenses go up and harder to save anything.

If all or part of your logical brain knows you’re spending more than you’re earning, that’s frustrating. But you can’t turn it around without a budget. That’s something 95% of people won’t do, because they somehow think it puts them in a straight-jackets. But it’s quite the opposite: A cash-flow statement, even just once, sets you free. You’ll know how much you’re prepared to spend for what each month. You’re not spending an unlimited amount of money that you don’t have groceries, lunch out, or the kids.

The best way is having the cash in a number of jars or envelopes. One envelope will be for groceries and food stuff. Every two weeks, the cash from your pay goes into the envelope. When you go to the store, it’s paid out of that money. When it’s gone – you’re done until the next payday. It works – but will you do it?

Hear me really clearly: You will never have enough money for what you WANT to spend. Never – no matter how much you earn. But you do have enough money for what you need to spend. But you have to manage your money, and not have your money manage you. I guarantee that most of us have a lot of our expenses go to the category of “not really sure.”

Save two weeks of your net pay in a separate emergency account.

Do a cash-flow statement of where your money is going to go for a full month. You’ll be really bad at it for the first three months and then you’ll love it and be really successful with it AND have at least $200 or $300 left over each month compared to right now.

People don’t decide their financial future with specific goal setting. They decide their habits, and their habits determine their financial future.

Human ATMs and a Rental Car Heads Up

Read the screen! The New York Times just reported on a lawsuit involving Dollar Rent A Car over allegedly charging the huge collision coverage so-called protection on their car rentals.

Dollar, Thrifty, and lots of others try to sell you, and when you decline the coverage (as you should), they may still leave it on the contract.

The Dollar lawsuit alleges that customers were clicking through the five or six different little computer screens and clicking ok. But what they didn’t see is that they coverage was shown as being accepted. You need to read each of those little screens to see it shows that you declined coverage. If not – you’ve signed for it, but won’t see it until you return the vehicle and get an actual printed statement. At that point, it’s too late and your credit card company won’t help you with a dispute since you’ve signed the agreement!

A great idea: 300 TD bank locations now have a coin counter machine right in the branch. It’s free if you’re a TD customer. I love the idea and the customer service. I just don’t love the idea that you have to be a TD customer to use them.

Ever wanted to talk to a human at an ATM machine if you’re stuck or have a question? Bank of America CAN have a good idea: Yes, it’s true: The bank with THE worst customer satisfaction rating on the planet has come out with a great idea.

They’ve just rolled out a human being ATM being tested in New England. It’s a normal ATM, but artificial intelligence and a skype-like connection lets you talk to a real human being from 7 am until 10 pm!

Yes, right at the ATM you can get questions answered and do transactions that you ordinarily can’t do with an ATM such as split deposits, foreign currency transactions, etc. I love the idea and hope, like everything else, it’ll come to Canada with one of the big banks.