Ah, another day, another incorrect online insurance quote. In my new part-time job to compare rates online, there appears to be a few more companies where your quote isn’t going to be close to your actual rate.

Lowestrates.ca is one of a number of sites you’ll find on the first search page under “insurance quotes.” They are not an insurance company or a broker, so they’re not liable for the common bait and switch – or “your quote isn’t actually your rate.” But you do need to know what happens after you fill in your online quote and it pops up with “your best quote” before you get your hopes up.

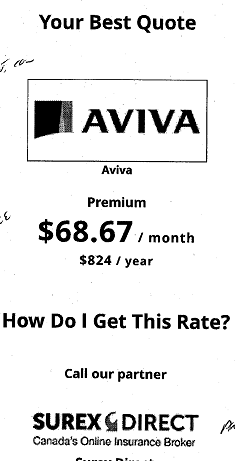

Mine was $824 and came up with Aviva Insurance. Since they don’t sell directly, the referral (and how lowestrates.ca makes their money) was to Surex Direct Insurance. Surprise, surprise, the actual quote from them through Aviva was actually $895. Yup – another quote, another “not close” in being over by $71.

Aviva chose not to reply to an inquiry. To their credit, lowestrates did reply to my email with an apology for the lack of communication. They also reached out to the broker and claim that the quote provided was “accurate to the dollar.” The broker, Surex, claimed that the information I provided wasn’t accurate. It’s totally false, but an excuse or reason why the “real” quote wouldn’t match the online quote. Their response indicated that “date first insured” was June 2001 “based on autoplus.” Nope – my first insurance entered accurately was a long ways prior to that.

Again, their information is false and there’s no chance you or me have of getting it accurate. Hands up if you have your insurance receipt from 19 years ago to prove your prior coverage? No – didn’t think so… According to a ballpark figure of a police officer friend about 10% of drivers don’t even have their current pink card with them.

The Statute of Limitations for most crimes and for keeping your tax records is about a third of that time. Yet insurance companies will punish you if you “only” have 19 years accident free coverage. Again, that’s inaccurate – but 19 years just isn’t enough to get a decent insurance rate?

It certainly isn’t right or logical, but is that legal or allowed by law? Has any consumer rights group ever asked why 19 years of coverage STILL isn’t enough for the lowest premiums? If so, send me a note as I want to contact them. I’ve also sent an inquiry to the Superintendent of Insurance to find out. Stay tuned…

George Boelcke – Money Tools & Rules book – yourmoneybook.com