The last few months of having the economy pretty much shut down is generally described as ‘inconvenient’ or ‘hard.’ But the people who are making those statements are likely politicians, economists, talking heads on cable news or medical people. Almost to a person, ‘hard or inconvenient’ is how they view it. However, these politicians, economists, TV anchors or medical professionals are all earning over $100,000 a year.

Put yourself in the shoes of someone who earns between minimum wage and maybe $3,500 a month. To them, it’s a nightmare and not just an inconvenience. Where you are on the income scale makes all the difference in how you see and feel and hurt in this pandemic.

The US Bureau of Labour Statistics (used from a CNN podcast this past weekend), which wouldn’t be any different here in Canada, reports that of the top 25% of income earners, over 60% are working from home and getting their paycheques. But in the bottom 25% of income earners less than 10% are able to work from home. THAT is the difference in the mindset and language of someone who is inconvenienced having to work from home but still getting full pay and the lower income 25% who need to GO to work to get paid. Plus, 13% of those over $100,000 have been laid off versus almost 40% of those under $40,000. That’s pretty staggering and changes the situation from hard or inconvenient to devastating and a nightmare.

The lower income 25%, or those earning less than $40,000 are also the largest group of renters. What’s happened to rents over the last 10 years? Rent keeps increasing because of property values, taxes, utilities, etc. going up. The top income earners either don’t have a mortgage or can make a call to their bank and may get deferrals or at least a line of credit to ride out the storm. What do families making under $40,000 do?

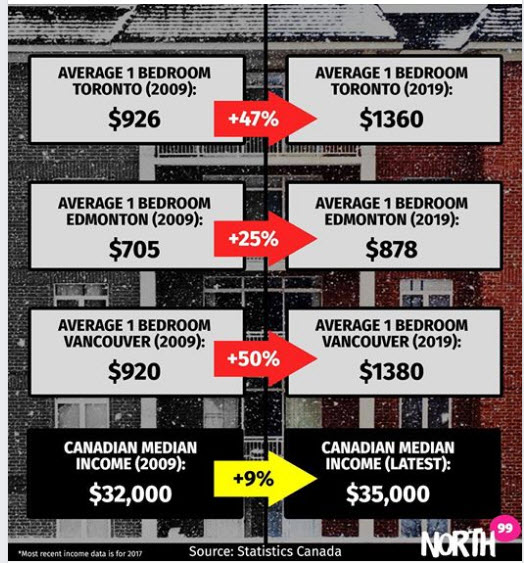

In the last 10 years, according to a report by Statistics Canada, rents in Toronto have gone up 47%. In Vancouver up 50%, and in Edmonton – not exactly a hot real estate market, rents are still up 25%. You know that incomes haven’t even kept up with inflation. So in a so-called good or normal economy the squeeze was already happening. How do you afford a rent increase over double your raise? With borrowed money for the difference – if not a second job. After all, you can only downsize your rental place to a certain point.

I don’t have answers, but if nothing else pay attention to the language you hear being used in an economy worse than the great depression. The perception of how ‘inconvenient’ these times definitely depends on your perception and reality…measured in large part by your income…