After three emails from listeners and two from relatives, it’s probably worth the time to put things in perspective. I only do about two segments on investing a year, because that’s not my degree or expertise, but these are just common sense…that we forget in the heat of the supposed “meltdown.”

First: These were the market returns last year:

Dow +22.3

S&P +28.5

NASDAQ +35.2

TSX +22.8

Markets do not go up by over 22% each year and every year. When it’s a huge year, there will be a pullback. That’s not a “meltdown” that is a correction to historical averages. And those are 10 to 12% a year on average. You can google that in 10 seconds or pull it up on my website under radio stories.

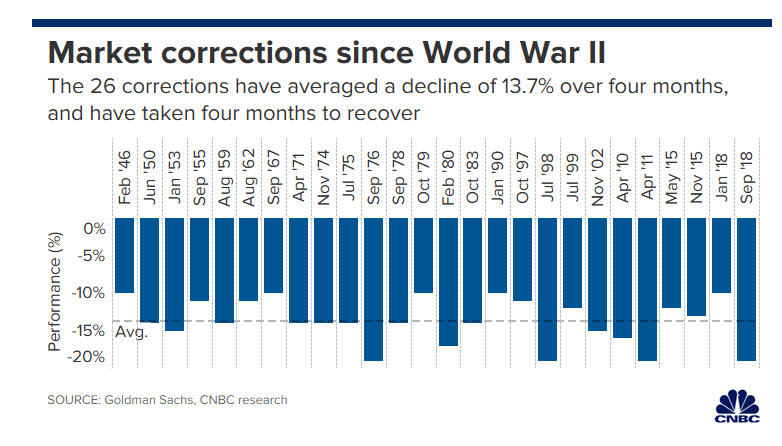

Second: When our investments go down in value we tend to think that we have lost money. Nope – that’s not correct. We are down but not out. We have lost money if we sell the investments and get out of investing. Then we have taken the cash out and have locked in the losses. If we stay invested, the market will bounce back. Always has and always will. Since World War 2 there have been 26 corrections for an average of over 13%. This isn’t breaking news, it’s part of the normal cycle of the market. I’ve attached a chart of it from CNBC.

Third: The so-called losses are mostly giving back the massive gains of last year and this February. It is not a loss of huge amounts last year on top of another wave of market drops this past week.

Fourth: Take your next six statements and put them away. Don’t open them and don’t watch BNN or any investment shows. I’m not an expert but I will bet a lot that you’ll have at least a 15% return by September. (From the March 3rd Dow close of 25,917 and S&P 500 close of 16,423) Markets always overreact and then have a massive bounce back as we saw on Monday. Ignore the wild fluctuations. If you are investing, that definition is a time horizon of five years or longer. Anything shorter than that should be in a savings account or under your mattress.