Since I always do what I teach on the radio and in my books, this year I needed to get my car insurance re-quoted. For a decade, Belair (formerly Canadian Direct Insurance) has pretty much been the least expensive – but that appears to be over. Enjoy their ads on the CFL games and leave it at that…

Most insurance companies will now let you get a basic quote online. One of them is The Personal. You’ll get what they term “your insurance premium estimate” with a long legal waiver that states that the quote is based on your information supplied, and is an estimate and not a guarantee. Fair enough. It goes on to state that your rate quote can change based on “additional information.” That would include your credit score and pulling your drivers abstract and anything you didn’t complete online.

OK. But what if your online information is entire accurate, your drivers abstract is totally clean, your credit score is fine, and you want exactly the coverages you filled out? Shouldn’t your quote be the same as the final calculations? You bet! But with The Personal, it wasn’t even close! I have no idea if it’s just a come-on, totally misleading, or just a rip-off.

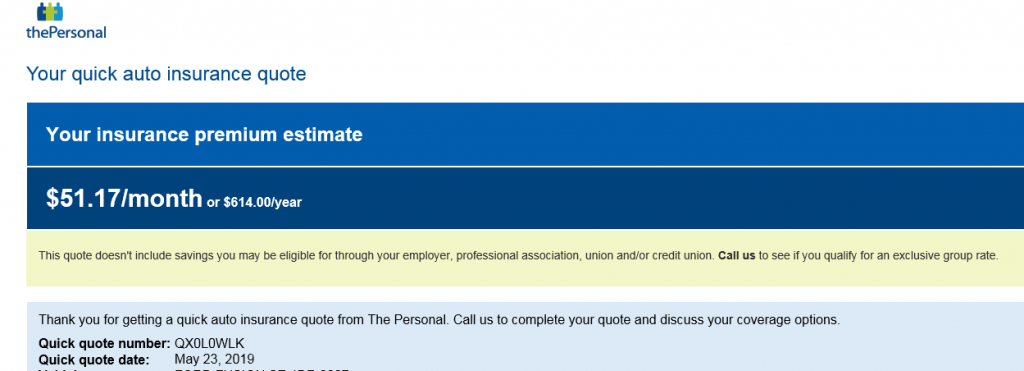

Here is the online quote for $614 a month. After a 30-minute call to their Calgary office, it turns out the actual rate would be $759, or over 23% higher! (Excluding my change to $2 million liability for $90 and their so-called “accident rate waiver” of $55 for a total of $904.)

Needless to say, I was stunned. When I asked the agent what DIFFERENT information she had entered that I had NOT done, she confirmed that nothing was different. When I asked how the premium increased by 23%, she couldn’t answer it. She did indicate she would “ask one of our technicians” and get back to me. To her credit, she did leave me a message the following day: The online quote uses ‘an average group discount’ to calculate your premiums and it does have a waiver on the site.

Well, not true: When you first start entering information (on many sites) you’re asked if you’re part of any group or association. Some are just to make you feel better, some larger ones such as being a Federal or City employee or working for a large company, can get you some worthwhile discounts. But I had checked the box that I am not part of any. So to tell me that their online site uses ‘an average group discount’ is just a big fat lie. It states right on the email quote that it “DOESN’T include savings you may be eligible for through your employer, professional asocial, etc.”

Does a website waiver just give an insurance company full permission to mislead someone doing an online quote? Is it just a total waste of time to get an online quote? Is this even legal? The Personal chose not to reply to my emails, but I’m awaiting to hear back from the Alberta Regulators…stay tuned…