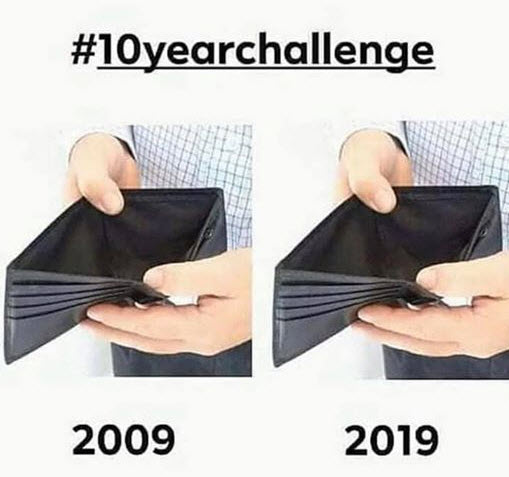

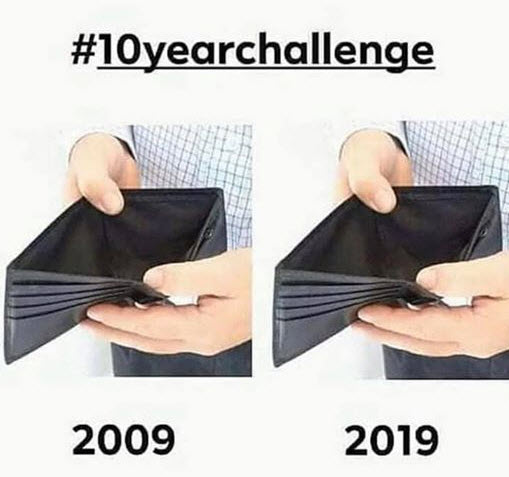

Facebook people have a new (to me stupid) “challenge.” Post a picture of you 10-years ago and now. No thanks…but here’s one that should apply to a lot of people:

Facebook people have a new (to me stupid) “challenge.” Post a picture of you 10-years ago and now. No thanks…but here’s one that should apply to a lot of people:

A few months ago, 60 Minutes re-ran a story on the 2nd biggest fraud since Bernie Maydoff, with reporter Steve Kroft. It was an interview with Marc Drier, whose ponzi scheme defrauded people of almost $400 million.

I want to read you a section of the interview, and then translate it to you and me:

Kroft: So you were digging yourself into a hole?

Dryer: Very much so. You start with something that is manageable and small. You know it’s wrong, but you think you can fix it and you can’t get out of it. It becomes quicksand. I had to keep meeting obligations that became bigger and bigger. (I was) creating an illusion, all mortgaged to the hilt.

I recognized in the last couple of years that what I saw as a $20 million mistake had grown into a mistake of a few hundred million dollars. And then, I did some increasingly irrational things, because I wasn’t thinking clearly…(and) I’ve lost everything.

Now, let’s translate that to the financial situation so many people face:

So you were digging yourself into a hole?

Very much so. I started with some borrowing that was manageable and small. You know it’s wrong, but you think you can pay it off soon, but can’t get out of it. It becomes quicksand. I had to keep meeting obligations and payments that became bigger and bigger each month. (I was) creating an illusion of a lifestyle that was all mortgaged to the hilt.

I recognized in the last couple of years that what I saw as a small mistake had grown into a mistake of (however many dollars).

And then, I did some increasingly irrational things, because I wasn’t thinking clearly. Like taking cash advances, stretching my car loan, getting a line of credit, living on my overdraft, going to a Payday lender, getting behind on my bills…(and) I’ve lost everything.

That’s millions of families that don’t or won’t do a budget. Families that refuse to live on less than they earn, and still kid themselves into thinking that loans and borrowing are a blessing and part of a solution.

This week, RBC released their Consumer Outlook survey, and it shows that more and more of us are worried about our debt load. I think that’s great news in that we’re finally getting real and seeing that borrowing money does not work, and being broke is not a fun way to go through life.

Fundamentally, it’s a real problem when we stay optimistic about our debts. THAT is what gets us broke! When we talk ourselves into buying this or that on credit, thinking that the payment isn’t that big a deal, we’re on a slippery slope of trouble. We block out the fact that it might take two minutes to spend it, but it’ll take years to pay it off!

A way better mindset is to be pessimistic about our debts and optimistic about our incomes. Instead, the survey shows that we believe we can become debt free reasonably quickly, but we’re worried about our job security. To me, that’s the wrong way around. We should be pessimistic about our finances. It’s what makes us realize maybe we can’t pay that payment for years, what happens when rates go up, I’m going to be in trouble if I carry my credit card at the max, and so on.

Yet, on the income side, 24% of us are worried about a job loss. To put it in perspective, however, the unemployment rate is 8.5%. But 5.5% or so is full employment. We know that from just a year or so ago. So, the real unemployment rate is around 3% and 24% of us worry. That’s a total disconnect between the two!

On the optimistic side, thinking we’ll pay off our debts pretty quickly, the numbers are even more surprising:

18-34 year olds expect to be debt free by age 43.

35-54 year olds think it’ll be at age 59. Yet, the group that’s closest to that age, those age 55 and older, think it’ll be at least until age 66! So a heads up to those under age 34: It ain’t going to happen! No way, no how – honestly. Sorry to be the bearer of bad news, but the reality is that you’ll likely have a mortgage payment of 25 to 30 years which right there, alone, makes it impossible.

And almost everyone under age 54 has a car payment. The average car payment is $480, financed over seven years. What’s a seven year old car worth? Exactly. So what happens then? We finance another one and go on another seven year broke cycle. Skipping one of these seven year finance cycles and putting that money into an investment account or RRSP will be over a million dollars when you retire. Instead, we buy something that’s worth less and less each month and keep paying and paying.

Keep in mind that every time you commit to a payment, you’re voluntarily taking a pay cut! That payment has to be made, so it’s money you no longer get to keep! It may be that $200 credit card payment, $400 car, the financed furniture, or whatever. Yet, if our boss wants to give us a pay cut we go insane. But we do it to ourselves every time we borrow!

One more thing which will become really important to all of our finances over the next year or so: The RBC survey showed that only 57% of us think interest rates will go higher. Excuse me? Rates are the lowest they’ve been in generations. So when they move, where do they HAVE to go? Up! And every line of credit and every variable mortgage will take some big jumps. The It’s Your Money book has a chart that asks how ready we are for the next rate increase. Anyone with just $150,000 of debt being hit with a 3% rate increase will spend another $329 after tax for nothing but more interest. And if we say we’re broke now, where’s that $329 going to come from?

What can we do? The really easy basics that 90% of us won’t do:

-Stop borrowing – period. When you’re in a hole, it makes sense to stop digging. Debt is NOT your friend.

-Do a written budget each month to know, not guess where your money is going

-Stop going to a restaurant unless you work there

-If your car is financed – sell it, no matter what you owe. That saved payment alone will likely get all your other debts paid off within a year. Drive a $2,000 beater for a couple of years until you’re debt free.

-Pay yourself first: Have some money taken right off your pay, or out of your bank account towards savings. If you don’t see it, you can’t spend it.

-Leave the credit cards with a relative. Out of sight, out of mind, and start paying in cash or by debit card.

-Get an emergency savings account of two weeks income so the next crisis will just be an inconvenience.

A survey weeks ago by the Canadian Payroll Association found that around 60% of us live paycheque to paycheque. While their president stated he was very surprised that people were so close to the line, we shouldn’t be surprised at all. In fact, I believe the figure is actually higher!

Being poor and broke is most often a choice. We create our own mess, the mess doesn’t just happen to us. No, not consciously, but in the financial decisions we make, the debts we take on, and our priorities with money. I know that if I spill a cup of coffee, right now, this minute, I’m going to clean up the mess. That’s a cup of coffee – why don’t we take that same attitude towards our finances?

To change it around, we can spend less, or earn more. Either one works, both together change our financial situation that much faster. If we wanted to, by next week, we can make around $1,000 extra each month delivering pizza, the newspaper, or a bunch of other part time jobs. If we wanted to…

If we wanted to, we can sell our car with the big payments by next week, and drive a $2,000 beater until we’re debt free. Just not having that car payment is a huge amount of money that could go to paying off other bills. If we wanted to…

People don’t move until they’re fed up and mad with their financial situation. When we no longer want to live in the state we’re in, you’d be amazed how quickly we can change it around. But until then, we keep confusing our needs with wants, and just give our money to everybody but ourselves.

We’re like an ATM – two paycheques go in, and all the money quickly goes out to make every payment in the world, and we just hope that we’re not out of money before we’re at another payday. Everybody has their hand out for our money and we give it to them voluntarily, and then complain that we’re broke. That’s not a life – that’s surviving, and it’s not a fun way to go through life!

At some point, all the stuff we’re still paying for isn’t worth the financial pain we’ve taken on. At some point, hopefully soon, it has to become an issue of the heck with the cheeses, I just want out of the trap!

In relationships fights over money is one of the #1 issues with couples. It’s the biggest cause of divorces, and a huge contributor to male suicides. We hear this, we experience the fights, and we STILL keep doing what we’re doing? Does that make sense at all?

People know how to get wealthy and know how to avoid making their financial situation worse. But why don’t we take the steps to make it happen? The bottom line is whether we’re prepared to do what it takes to turn it around? If so, it starts with some easy steps that very few people take:

Sit down without the TV and the kids and do a written budget with your partner. Every dollar is planned, and nothing gets spent over and above the budget. It’ll really clearly show you where all your money is going. If the budget is $600 for groceries, $300 cash goes into an envelope or a jar for the coming two weeks. When that money is gone – you’re done spending.

Step two is to get an emergency fund of one week’s gross pay into a separate savings account. Stop being naïve – there will be an emergency. This small rainy day fund is critical. It will rain – you know that!

Step three is to focus on paying off your debts. No RRSP savings, no investments, no vacations, and you’re not seeing the inside of a restaurant unless you work there. But rather a 100% focus on getting debt free except the mortgage. The It’s Your Money book has an easy to understand section that has you list your bills smallest to largest, then every dollar goes to the smallest debt until it’s paid off. Then it rolls to the next one, and so on.

There was a survey done of the richest people in the world from the Fortune 400 list. Seven out of ten started with nothing. Their wealth was built entirely on their own, without inheritances. When they were asked what the number one key was to building wealth, the answer was always: Get out of debt and stay out of debt.

It might seem cruel, but if were to be honest with ourselves, would we agree with this line from Larry Winget’s book jacket: People want what they’ve got. It’s a simple formula: You have what you want because your actions produced your results.

Can you get out of the life of living payday to payday? You bet. Do you want to? I’m guessing we all do. Will you do what it takes to make it happen? Ah – that’s where 90% of people choose not to…