Whenever I get emails from people asking for feedback or help with a financial mess, I’m more than glad to help. No, I don’t charge for it. I believe God gave me a purpose and passion and it’s called paying it forward.

But at some point, most people are really not interested in doing much (or any) heavy lifting. And I can’t fight harder for them than they’re prepared to fight for themselves. That was confirmed again by the last BMO Savings Survey. 30% of people want to save more but do not want to change their spending habits. Sorry: You can’t get there from here – it can’t happen.

The emails have a pretty consistent theme: Someone is spending more than they’re earning and they’re in pretty deep debt. I’m not in the middle of their mess, so it’s easier to see the fixes that’ll turn things around. Here are some of them that will sound so obvious, but they’re anything but when you’re in the middle of it:

No, you can’t send your two kids to private school when your income is $45,000. You can’t afford it. It doesn’t make you a bad parent, it makes you a great and responsible parent who can do 5th grade math.

You have a cell bill of $140 a month. That’s insane. It wasn’t that long ago you managed to live without a cell. Now anything but a full unlimited plan is a necessity that you can’t do without? Mine is $39 with data.

Sell your car and get out from under the $1,100 car payments. They’re killing you. Drive a $3,000 used, reliable car that you buy for cash until your debts are paid. When you can afford it, you can turn right around and get an idiotic $1,100 car payment again if the debt-free thing doesn’t work for you. But you won’t do with, giving me two or three totally bogus reasons…actually…excuses why you love that $1,100 payment more than you’d love saving the same $13,200 a year.

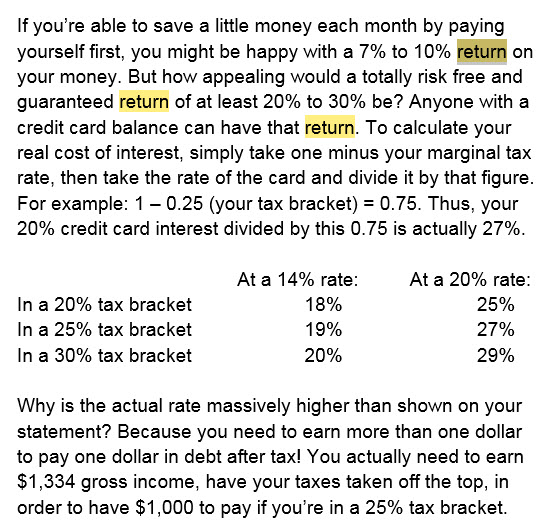

You say you need to keep $4,000 in your savings account at half a percent while paying 22% on your credit card. Keep $1,000 as a starter emergency account; pay the rest on your credit cards today!

You don’t know the interest rate on your credit card and only know that you’re paying minimum payments of around $200 a month while charging about $800 or more. So you’re going further in the hole each month and tell me you have to have your credit card. Yes, you do. Because you’re so far in debt, that’s your only way to buy groceries and gas right now.

That’s just some of the very common ones. So what exactly do you want help with? You won’t downgrade your car, your cell phone, switch to an 11% credit card instead of 22%, or stop your credit card addiction. News flash: I’m out of ideas to help you. The only other thing left is for me to send you $1,000 a month. Is that why you got in touch with me? That’s not being rude, it’s caring enough to be honest, and seeing the reality of your income and expenses. Numbers don’t lie.

You don’t have a money problem as much as a spending, thinking, planning and discipline problem. You want your toys, gadgets, and vehicle more than you want financial freedom and becoming really wealthy.