If you’ve procrastinated making an RRSP or TSA contribution for 2020, you’ve got eight days left, but you might want to skip it this year.

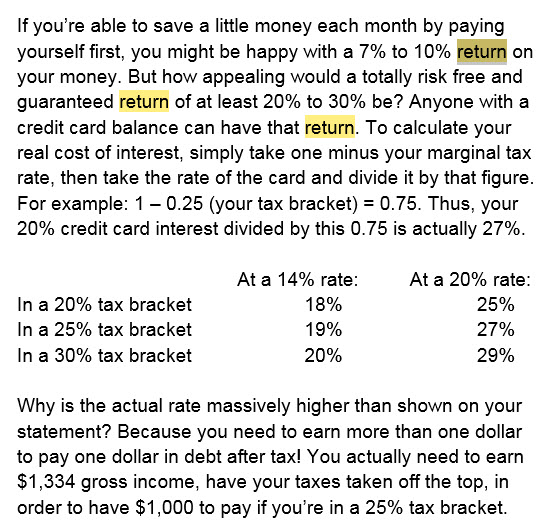

What if I could get you a guaranteed and totally risk free return of 27%? Would that sound better than an RRSP or TSA this year? If you carry a credit card balance, like half of card holders, that’s exactly what you’ll get. Here’s an excerpt from the Money Tools book (page 144):

If you have a 10% line of credit, even in a pretty low 25% tax bracket, your real return will still be 13.3% if your priority is to pay that off.

What’s the bad news? You cannot do that if you want to save and become debt free at the same time. I’ve never seen anyone do it in 25 plus years, and you can read any number of Dave Ramsey books and find him confirming the same thing for just as many years.

We just don’t have enough money left over after paying all of our bills to make that last $200 bucks or so stretch to cover investing and paying off our debts. We can barely make the minimum payments each month. If you believe you can do both, it is the equivalent of attempting to defy the law of gravity. It won’t happen – but good luck to you. In two or three years, you’ll be exactly where you are today.

If you take three, four or five thousand dollars this week and put them into an RRSP or TSA while you’ve got high interest debt, such as credit cards or an overdraft, you’re making a big mistake.

If you’re going to borrow money for an RRSP contribution, I would suggest it’s an even bigger mistake because you’re adding to your debt and monthly payments. That’s exactly the opposite direction of where you should be going.

Yes, you should save and invest for your retirement. But a year or two of pressing the pause button is the only way to become debt free. If not, you’ll be another two or three years older, just as broke and just as poor. Before you make that pretty critical decision, read the Money Tools book chapter: Getting from here to debt freedom on page 207. You can get it from Mosaic Books on Bernard before you head to the bank to make your 2020 contribution…

(And since I always show my work: The $20 book, if you follow the two chapter sections, and what we talked about on the radio today, will end up saving you $1,530: You won’t have the 10% historical return of an investment over the next three years = out $993 compounded for three years. But you’ll have $3,000 less credit card debt at 27% (in 25% tax bracket) for a saving of $2,430. $2,430 less $993 = $1,437…excluding any tax refund – if any – if RRSP)