Banks started offering payment deferrals about a month ago, and it’s now over half a million who have done so – and that’s just mortgage payments. But there may be a problem, especially for the early applicants: It may have destroyed your credit rating.

But let’s back up a minute first. There are two credit bureaus in Canada. TransUnion and Equifax. Unfortunately Equifax has 90% of the business and is the primary source for almost everyone but Scotia. They’re just a really horrible company for lots of reasons. But both credit bureaus, when the thought of extensions started immediately called on the banks to set up the correct coding for these extensions. But the banks were slow to get this done.

If our listeners had only a one number code to rate the segment, it might be 1 for great, 2 for boring, 3 for make George go away, or 4 for average. That’s it – four codes. That’s how the credit bureau does things. But a deferral didn’t have a code set up. So a ton of the first deferrals went through as unpaid – which means behind in payments – which means a huge drop in your credit score until the banks reported the deferrals with a new code.

The how to check your files is in the credit burau chapter of the Money Tools book. Just go online to Mosaic or yourmoneybook.com if you don’t have a copy.

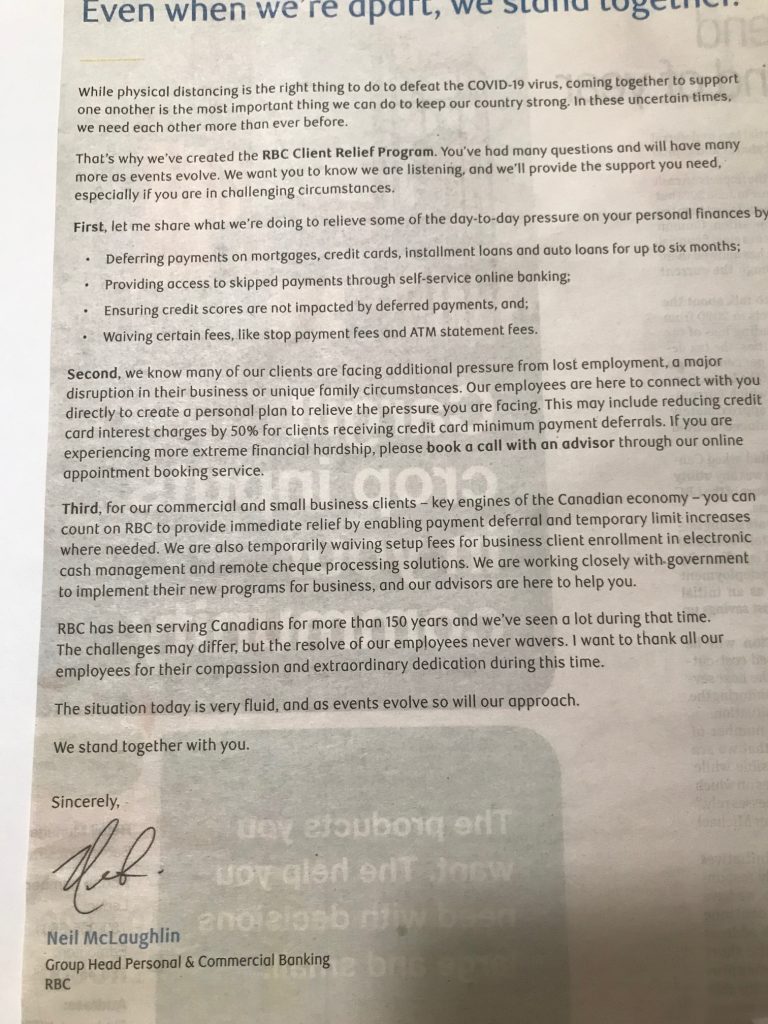

If you’re impacted, it’s obvious that you need to get this corrected – and that could be a part-time job. If you deal with the Royal, their Canadian President had an ad in newspapers across Canada the first week in April. In there, it stated that they will “ensure credit scores are not impacted by deferred payments.” Here is the full ad:

If yours was, here is the contact information for the President who wrote the ad:

Neil McLaughlin, Group Head – Personal & Commercial Banking 200 Bay Street, PO Box 1, Royal Bank Plaza Toronto, ON M5J 2J5 Phone: 888 212 5533 (your odds are zero of even reaching his EA, though and you want your issue in writing anyway) Fax: 416 955 7800

If your credit report problem is not with the Royal, you’ll need to do some online searches for their head office and/or a Regional VP and an address.

And here is a form letter that you can use. Search under radio stories to get the information on how to complain effectively that we talked about a few months ago. Keep it simple, keep it short, factual, and state what you want to achieve. And always always keep every copy of every letter or email and a record of every call and the time, date and who you spoke to. This is too critical not to be disciplined!

If you don’t deal with the Royal, you can use the same letter, just take out the section referencing their advertisement.

Dear Sir:

Re: Incorrect credit reporting of my deferral

Your bank processed a deferral of my (mortgage/credit card/line of credit/loan) payment in the month of xxx.

However, my credit report since that deferral shows it reported by your bank as past due. That is NOT correct and has to be corrected. As you know, this has a huge impact on everything from my insurance to interest rates and future borrowing! As you also know, the credit bureaus (TransUnion and Equifax) cannot fix this error as (you) the lender has to submit the right reporting information to them.

Your national advertisement the first week in April, under your signature, stated that you were “ensuring credit scores are not impacted by deferred payments…”

I need to have someone in your office correct the coding from the incorrect “past due” to the corrected “deferral,” and re-report it to the credit bureaus.

Or in the alternate supply me with the proper person, their address, and/or email in your bank that I need to contact to get this corrected immediately.

I look forward to hearing back from you – thank you in advance,

Yours truly,

(Your name)

Address:

Telephone #:

Branch you deal with and main account #:

Account # of deferred credit card, loan, line of credit or mortgage

AND send or deliver a cc copy of this letter to your branch as well!