Mortgage deferrals this spring: It’s nice to know that many times our Wednesday stories are ahead of others talking about it. May 6th we talked about a heads up that you need to check your credit bureau if you had a deferral on your mortgage or line of credit. BNN finally had it on their website August 13th – three months after us. To make sure your deferral hasn’t shown up on your credit report as arrears, go to Equifax.ca for the form to get your free report or it’s in the Money Tools book chapter on credit reports.

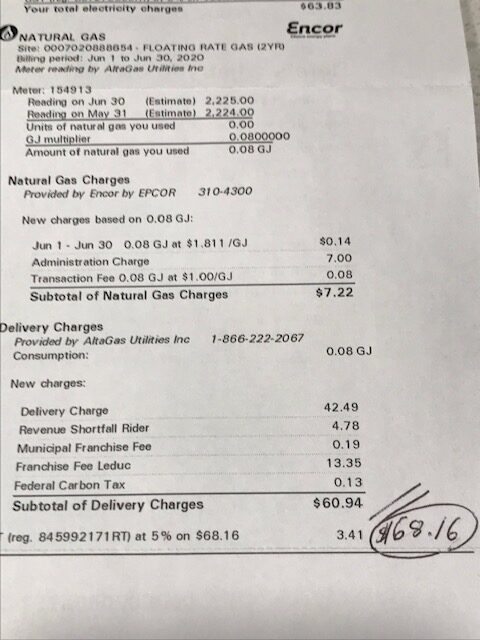

Solar panel payback: Last year we talked about the cost versus savings of adding solar panels to your house. It might be great for the environment, but it’s horrible for your wallet. The savings will only be your actual energy consumption cost. You will still have all the fees on your bill. Here is my last utility bill as an example. My actual gas cost was 14 cents. I know it’s summer, but even a really low $10,000 solar install will save me 14 cents a year, or around $50 in the winter. The other seven charges were over $67 and you’d pay no matter what.

Car rental reminder: If you didn’t hear it last year, this is your reminder: It may be weeks later after you return your car that you’ll get a bill for damages to your rental. It will be a bill in the mail or they may already have charged your credit card. All rental agreements state that it’s subject to final inspection. Many times, especially at airport rentals, you just hand in the keys and they never look at the returned car at the time. That’s happening more and more as you can see on travel blogs. So take pictures, it’s digital so it’s easy to do. One of the windshield, and one each side, front and back! That way you’re protected…just in case…

Teaching kids about money: We talk about this at least once a year. Here’s a beautiful reminder that kids DO understand if there’s financial trouble. If Mom or Dad are off work because of the covid pandemic, you can, should – actually must – talk to your kids about it. Make it age appropriate, but do make it a conversation. This beautiful note is from one boy for his Mom.