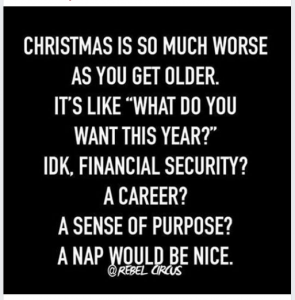

Well, maybe that’s a little extreme – but I’m just talking about the excess spending part of the holidays.

Whether it’s Covid, lockdowns, inflation or recession, on average, we spend more than $700 on gifts. But we’re already spending over 165% of our household income each year, and our savings rate is barely four percent. That means most of our holiday spending will need to go on credit cards. Ouch!

When asked, the average person claimed it took two months to pay off their holiday shopping. Yet the actual time was over six months! Let’s face it – July is NOT when you want to deal with last years’ holidays!

And it’s not just the gifts we buy, but also the added spending for trips, the tree, decorations, cards, postage, concerts, clothes, hairdressers, all that food, and the total amount quickly adds up.

So here are five tips to financial survival this years’ holidays:

Cash is king – when you’re paying, there’s a very different feeling to laying a bunch of $20 bills on the counter instead of using a credit card. With a number of cards, there’s no reason to stop, and merchants know that the average purchase is much higher when customers pay with by credit card!

Get realistic – make some kind of simple budget, stay within it, and practice the four most powerful words nobody ever wants to say: “I can’t afford it.”

Know what’s important – resolve to make this holiday season less about money. Focus on the difference between the meaningful and the meaningless. This might be time with your family, a donation to your favourite charity, your faith, or many other things.

Speed kills – it’s not just a traffic rule, but also includes your impulse purchases. It will almost always cost you more money if you don’t take the time to shop around.

Make a list and check it twice – it works for Santa, so discipline yourself as well. Don’t leave the house without a list and a good idea of what you’re looking for, as well as a price range. Cruising the stores is frustrating and many people tend to just buy something – anything – just to get on with it, and that’s never a budget smart way to make purchase decisions.