Having a decent credit rating in today’s society really isn’t an option – it’s almost a must-have. Apartment management companies will make their decisions based on your credit score, bonding companies, large numbers of hiring managers, not to mention all financial institutions, for everything from opening an account to your ATM limit, a credit card, or loan, will pull your credit score.

That makes it critical for you to get and keep a decent and clean credit report, or to rebuild it after something has gone off the rails. You HAVE to read the credit score and the building credit chapters in the Money Tools book. That $20 investment at Mosaic on Bernard or Amazon will literally turn into thousands of dollars saved on any financial stuff – or even getting the job or apartment you want!

If you’re starting credit, you’re building it. If you’re re-establishing credit, you’re healing AND starting credit again. They’re both similar in what you need to do.

The simplest way is through either a small limit credit card of a cash-collateral loan. The smaller the financial institution, such as a credit union, instead of a bank, the more they’ll help. Sorry, but to the banks, you’re one person out of the ten million credit cards they already have – and they can do without one more. Get a credit card with a $500 limit and never charge more than $100 on it. You need to keep your balance at less than 20% of the limit. In a year, they’ll increase your limit and inside a year and a half, you’ve got perfect credit if you don’t start applying at a dozen other places and going badly into debt.

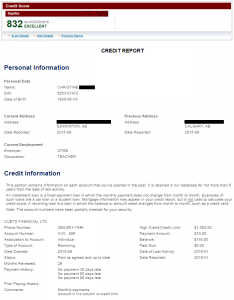

Don’t believe me? Below is a print of the credit score of an 88 year old. Less than two years ago, she needed a small credit card. That’s exactly what I set up for her. Today, her credit score is 832! 850 is a perfect score, so she’s in the top one percent of the country at age 88, in a nursing home, living on old age pension!

If you need to first heal your credit, a cash-collateral loan is borrowing $2,000 or so but leaving that $2,000 with the lender as collateral. Set it up for 12 months and the tiny bit of interest you pay is worth the cost to re-establish your credit. First ask if they’ll do an RRSP loan. That’s a win-win-win to build credit again, save for retirement, and build your credit. But if they say no, it’s only because they cannot take the RRSP for collateral. Then, plan B is the cash-collateral loan. Once you’ve done that, don’t do anything else. Your bad credit will get older and start to drop off your credit report, but the new loan will be fresh, up to date, and reporting monthly to the credit bureaus. Don’t borrow more – you can’t speed up the calendar. Get this done and take a one or two year time out and you’ll be back on top!